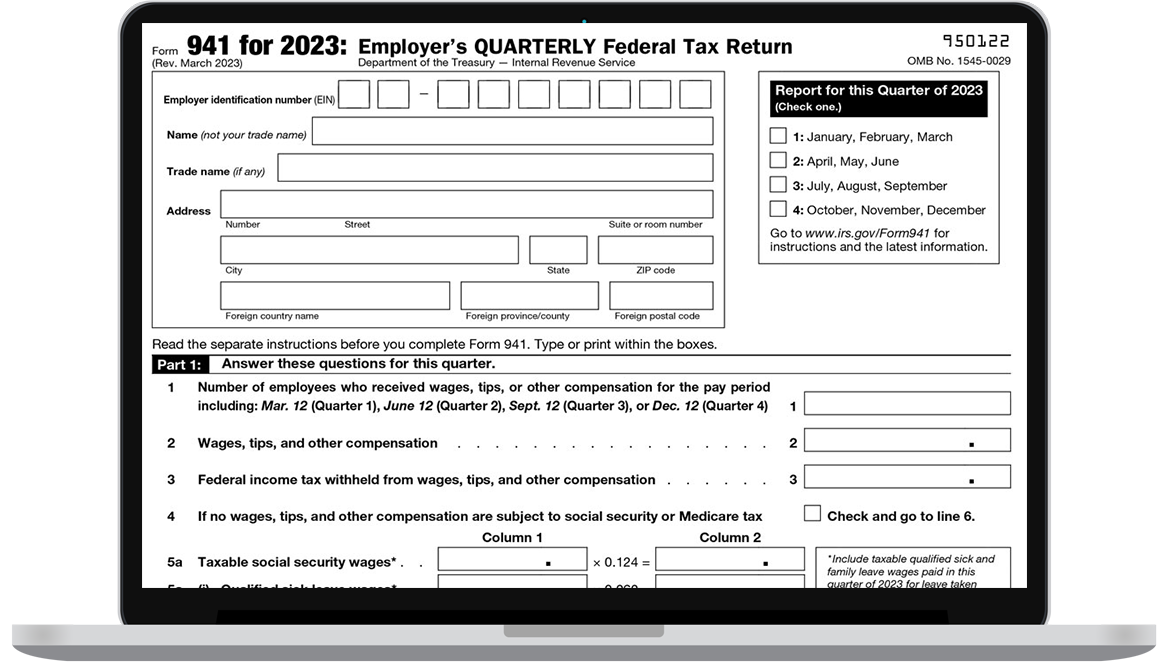

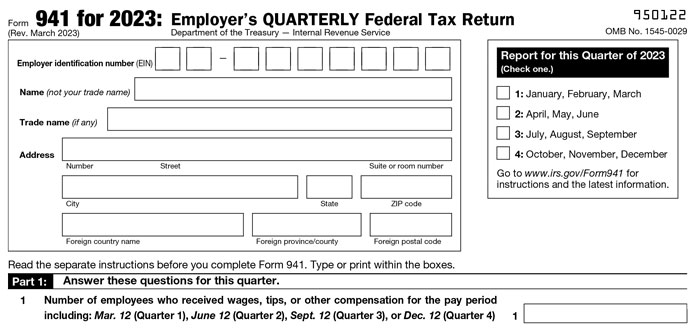

What is 941 Tax Form?

The IRS Form 941 is a Quarterly Tax Return used by employers to record the Federal income tax, Social Security tax, and Medicare tax withheld from each employee's wage (FICA taxes). This form is also used to determine the employer's Social Security, Medicare, and other withholding taxes.

Visit https://www.taxbandits.com/form-941/what-is-form-941/ to find out more about Form 941.

What are the Changes to Form 941 for 2023?

The IRS has published Form 941 changes for the first quarter of 2023. Before filing for the first quarter of 2023, employers should be aware of a few changes, which are listed below:

- The second worksheet for Form 941 is now available.

- For increased research activities, small businesses can claim a tax credit of up to $250,000 per year.

- After the 2023 tax year, the 941 PR and 941 SS forms will be phased out.

- Line 12 of Form 8974 has been renamed "Credit for the employer share of social security tax." In previous quarters, it was "Credit."

- The social security wage base limit for the 2023 tax year has been raised to $160,200.

- If your business is seasonal, Line 18 now has only one option to choose from, and you no longer need to record a return for each quarter of the year.

Visit https://www.taxbandits.com/form-941/revised-new-irs-form-941-for-q1-2023/ for more information on Revised Form 941 for 2023.

When is the Deadline to File Form 941 for the 2023 Tax Year?

Form 941 is typically due by the last day of the month following the end of the quarter.

First Quarter

January - March

May 01, 2023

Second Quarter

April - June

July 31, 2023

Third Quarter

July - September

October 31, 2023

Fourth Quarter

October - December

January 31, 2024

Visit https://www.taxbandits.com/form-941/form-941-due-date to learn more.

What is the Penalty for Failing to File Form 941?

If you fail to File Form 941 before the deadline, your business is subjected to IRS penalties,

and below are possible penalties for late filing Form 941.

| No. of days the payment delayed | Penalty Rate |

|---|---|

| One to five days | 2% |

| Six to fifteen days | 5% |

| Sixteen or more days | 10% |

| 10 Days After Receiving Notice from IRS | 15% |

Visit https://www.taxbandits.com/payroll-forms/form-941-penalty/ to learn more.

What Information is Required to File 941 Form?

Below are the following informations required to File Form 941.

- Employer & Employee Details

- Medicare and Social Security Taxes

- Deposit schedule and tax liability

- Signing Information

Know more about Form 941 Instructions.

Steps to E-File Form 941 with TaxBandits

Follow the below steps to E-file Form 941 with TaxBandits

Sign up to create a free TaxBandits account!

Choose Form 941 & Enter the details

Review & Transmit Form 941 to the to IRS

Frequently Asked Questions

What is Employee Retention Credit (ERC) in Form 941?

The US government endorsed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in March 2020 to mitigate the effects of an economic downturn during the pandemic. The Employee Retention Credit is one such provision in the CARES Act.

It consists of a refundable payroll tax credit of up to 80% of "Qualified Wages" paid from January 1, 2021, to December 31, 2022, and 50% of "Qualified Wages" paid to retain employees from March 12, 2020, to December 31, 2020. For each employee, the qualifying pay should not exceed more than $10,000 for the whole calendar quarters.

What is the difference between Form 941 and Form 944?

The Form 941 is a quarterly form used by employers to submit their federal income tax withholding and FICA taxes. IRS Form 944 (Employer's Annual Tax Return) is intended for small businesses and is used to report employment taxes. Small company employers with a $1,000 or less yearly liability for social security, Medicare, and withheld federal income taxes must file annual information reports.

What is IRS Form 941 Schedule B?

941 Schedule B is a daily report of the employer's tax liability for federal income tax withheld from employees which accompanies with Form 941. It also shows the employer's part of Social Security and Medicare taxes withheld over the period of time. This withholding information must be reported to the IRS on Schedule B Form 941 for each quarter.

Do I need to File 941 if there are no employees?

If you have no employees during a particular quarter, you do not need to file Form 941. Even if no wages are paid, most companies must submit Form 941. There are a few exceptions, such as employers of seasonal employees, household employees, or agricultural employees are not required to file Form 941. For further information on who is exempt from filing Form 941, see the IRS Form 941 Instructions.

How do I get a copy of my IRS Form 941?

If you need a copy of a previously filed form, you can request a copy by calling the IRS at 800-829-3676. You will need to provide your name, address, and Social Security number or Employer Identification Number (EIN), as well as the tax year and quarter for the form you need a copy of.

However, filing your Form 941 with TaxBandits allows you to view and download your previously filed Form 941 copies anywhere, anytime without any hassle.